Why sqft.

capital

was set upProperty development finance is difficult to access, lenders are difficult to compare and borrowers always need the best of market funding, quickly.

Our founder, an ex-developer, learned the hard way over 2 decades of property development and believes that with the delivery of the right technology – the process can be sped up and made more transparent for developers with little to extensive experience. However, in a specialist business, we believe human contact must remain paramount to solve problems, identify solutions and help developers get funded by the best lenders.

capital

How sqft.

capital

works for UK property developersOur story

The methods people use to borrow money maybe have changed how they look, but the essential structure is still the same: the lender is in charge. It doesn't matter if you're sitting across the desk at a bank, or on the phone to an advisor who has a lender in mind - you're at the end of a long chain.

But in so many other industries, the power of digital has turned this on its head. From insurance, to utilities, groceries and tickets; technology has come along and put the consumer firmly in charge.

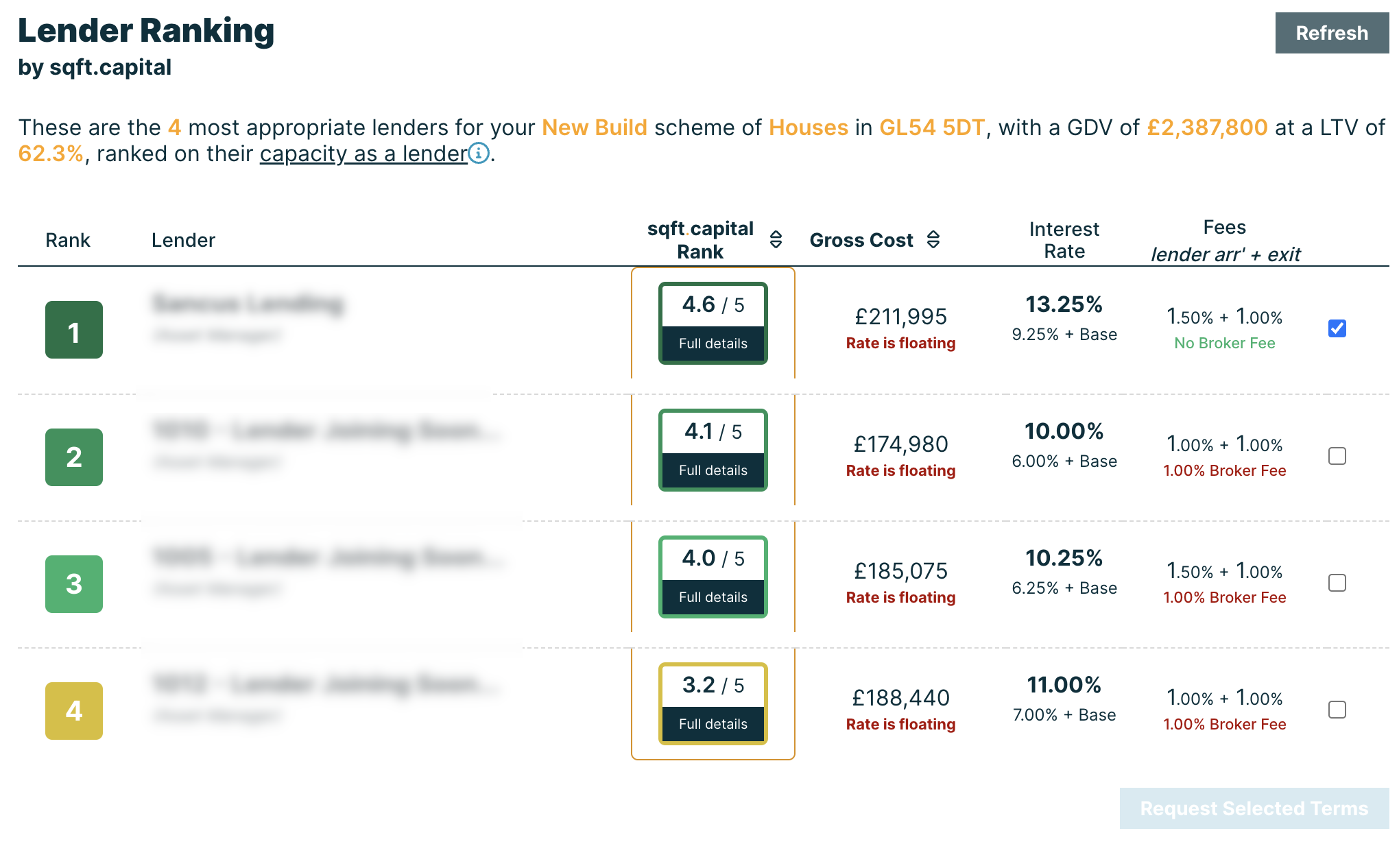

The development finance industry had been resistant to change. Cumbersome and time-consuming processes means that borrowers end up with an opaque, convoluted route to funding. We aim to transform this and improve the experience for everyone involved.

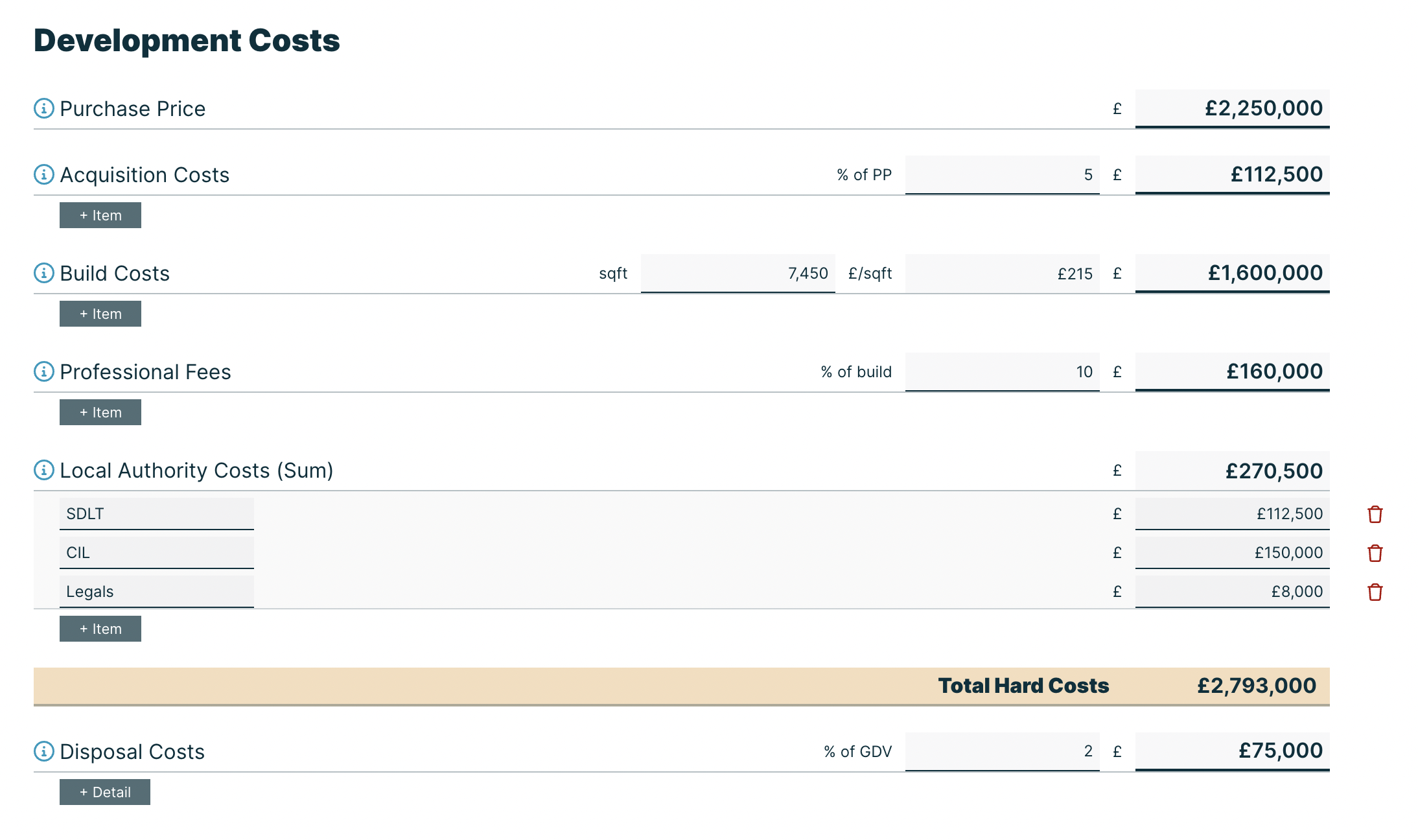

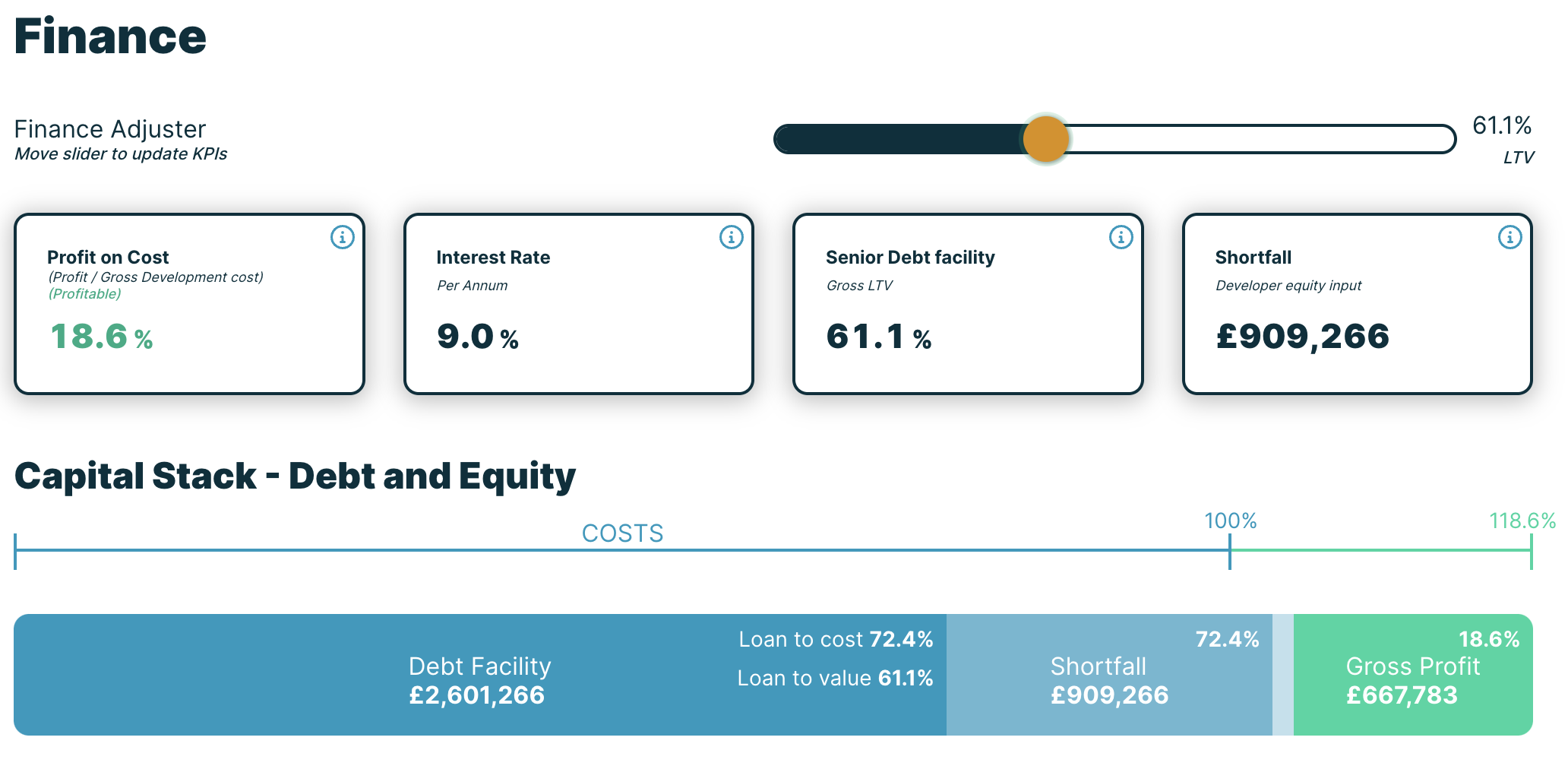

Borrowers expect a set a digital tools they can use at their own speed and want to feel ownership over how the model and optimise their requirements. Debt and equity lenders want a better way to visualise the data for profitable deals. And they both expect a blend of digital automation and human contact - which is at the heart of sqft.capital.

Our digital platform puts the power to model and access lenders in the hands of the developer and filters out the noise to help the find the partner they need. We're on call to help set up the deal when they need us. We think it's the most efficient way to finance development, and our users agree.

Meet the team

Want to hear more?

Sign up to hear useful information on leading market rates and lenders deals.