Debt lenders see hundreds of opportunities every month and lend on a handful. With every deal appraisal we see at sqft.capital - there is an opportunity for financial engineering and better presentation; making your deal more profitable or de-risked by the correct structuring of a spreadsheet and supporting information. Typically, this results in quicker and easier debt lending and at a lower cost or higher profit to you.

Debt lenders see hundreds of opportunities every month and lend on a handful. This means that their main job is to sift through all applications, identify the good ones and support them to their internal credit panel. This means that lenders see all types of presentation of deals - which ones do they support? The ones that are correctly and neatly laid out, show a clear numerical appraisal with supporting evidence and a clear business plan to make a profit - ideally this is all shown in a manner that is easy to read. By presenting a deal in this way, your scheme will quickly find itself to the top of the pile, well above the pile of fag-packet calculations. It is vital to note, lenders are not desperate to put money out of the door - their focus is to support profitable schemes from capable developers.

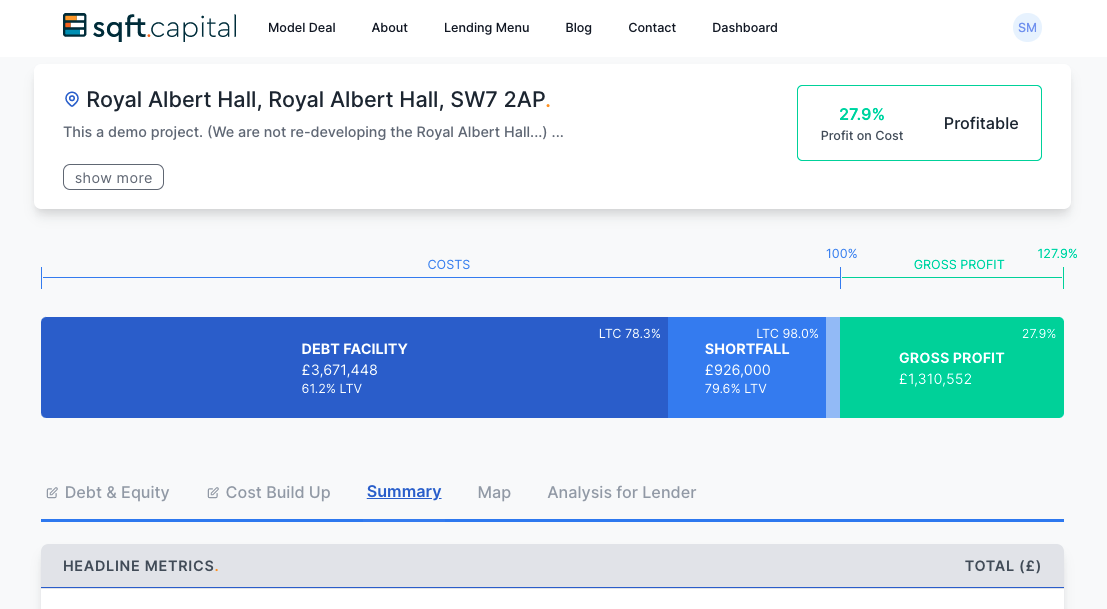

https://sqft.capital/ is building an evolving tech-platform to allow you to do all of this quickly, and for free.

All debt lenders have strict criteria they must hit in order to make a loan - and so many developers do not deliver this, meaning refusals to lend or long and arduous work getting information correct and ordered - all while under time-pressure of a seller.

Headline low-interest rates and high Loan To Values may sound appealing but do not equate to guaranteed lending. All lenders are competing with each other so have to appear more appealing than others, in order to stand out. They need to stand out to get leads sent into them. These headline rates are therefore not for the developer, but for the lender as a sales tool.

So what do debt lenders require from a developer?

From their perspective, they need to protect their money, reduce any risk of losses and have a predictable outcome (interest) allowing them to raise more money from their funders.

It is commonly thought that many debt lenders are a huge bank account which they are not - all debt lenders have to raise money themselves on which they have to pay a return so, in order to take a higher return from borrowers (property developers), they need to protect their loans to prevent default, and make their margin.

Any debt lender or bank will have to process all deals through a credit panel for “sanction” - which is commonly a board of directors and shareholders of the lender and their investors.

Therefore, the easier they can present your deal, the easier it is to get approval.

Only a fraction of development deals that lenders receive actually get sanctioned - so here is how to give your deal the best chance, the first time around.

Step 1 - Presentation

Make your summary deal appraisal clear and easy to understand in seconds. If a lender is seeing hundreds of these a month, how do you make yours the top of the pile? It is very clear to someone who analyses a lot, which ones have had time spent on them - a very profitable deal by a capable developer can be at the bottom of the pile if time is not taken to make easy reading for the recipient. Summarise and allow a linear understanding of all steps.

Step 2 - Give some headline information about the deal

Where is it, what is it, why is it profitable, who will buy it. Make this summary short and easy to read. Remember, you know the site - the person reading it knows nothing about it. Give them a quick understanding of the proposal and it will make reading the rest and understanding it much easier.

Step 3 - Numerical appraisal

Ensure this is clearly laid out; the same font, sums are all correct, systematic (i.e. costs are shown clearly and what for, exit value, profit). This is a business plan of how to make a profit - to someone who sees a lot of these, it is very easy to spot errors and assumptions. Take the time to make this tidy - random cell colours and #NAME? or #REF! look messy and rushed. If there are errors here - where else are there errors?

Step 4 - Supporting information

You know your deal/site, the lender doesn’t. How have you arrived at your build cost? How have you arrived at your Gross Development Value? It is easy to put a summary together - it is very believable and confidence-inspiring when this summary is supported by evidence. This can include an accommodation schedule, sales comparables, a Quantity Surveyor’s costing plan and your experience as a developer - which is critical.

You know your market (hopefully) so show that you do.

Without solid comparable evidence of recent property sales in the immediate area, you are asking a debt lender to carry out a lot of background research on your behalf, which they likely won’t because you couldn't be bothered to.

Show your GDV is reasonable and show that unlike some other developers, you are not being optimistic. All developers have confidence that their scheme will be the best thing to hit the market, so show you can sell yours on a bad day and make a good profit. You will get pulled apart on this and look like an idiot when a lender says “sorry but...”

Step 5 - Visuals

One picture or plan will set you apart - so include it.

A set of numbers is hypothetical but we are all visual creatures and need to attach it to something. For example, a CGI of a completed project shows an appealing end-result on which to look at numbers.

Step 6 - Experience

If the lender does not know you or has not actually lent to you before, show them straight away that you have experience.

List your previous deals, the owning companies, the costs and profitability (or loss, don’t be afraid to show this) and provide a list of your professional team (architect, designers, surveyors, QS etc.) - this gives huge comfort in the ability of the developer.

Step 7 - Detail

An initial appraisal should be high level, more detail can follow but let your appraisal spreadsheet clearly show the following data:

- Land/purchase costs - how much are you paying for the site.

- Acquisition costs - Stamp Duty Land Tax, legal fees, agents fees.

- Development cost summary - build plus VAT.

- Professional fees - surveyors, monitors, banks valuers.

- Disposal costs - agents fees, legal fees.

- Total spend pre-debt finance - this can be called “Hard Costs” or “Capital Expenditure” (CAPEX).

- Your expectation of debt costs - fees, interest, drawdown schedules, a cashflow.

- Gross Development Cost (GDC) - total costs, including debt finance.

- Your Gross Development Value (GDV) - how much it is going to sell for all done.

- Profit - GDV less GDC.

- Profit on Cost - The total profit, divided by the GDC. This should be a minimum of 20%.

Step 8 - Downside consideration

If your deal shows a healthy profit (20% on costs) with realistic costs, it will go a long way to show that you have considered any potential downsides.

- Have you allowed a contingency budget? Costs can overrun and if you have not considered this - it will show you are not factoring in any unknowns. 5% looks like a token gesture whereas a 20% contingency allowance shows your deal can handle an overspend and you are prepared in case this happens.

- Show what happens to profit if sales / your GDV goes down 10%. Show what happens if your build cost increases by 20%. If this makes a loss, you are being an hopeful optimist which is not a considered strategy.

- Show clearly your headline metrics - you average sales cost per sqft, your build cost per sqft, the profit erosion (i.e. how many months of debt payment would there be before your profit goes to zero.

To stand above others and be taken seriously by a debt lender, it is vital to show you have taken the time to prepare your appraisal for the respect of the lender.

Spend the effort and you will see the rewards.

Want to hear more?

Sign up to hear useful information on leading market rates and lenders deals.